Improving Your Trading Process: Analysis, Synthesis, and Action

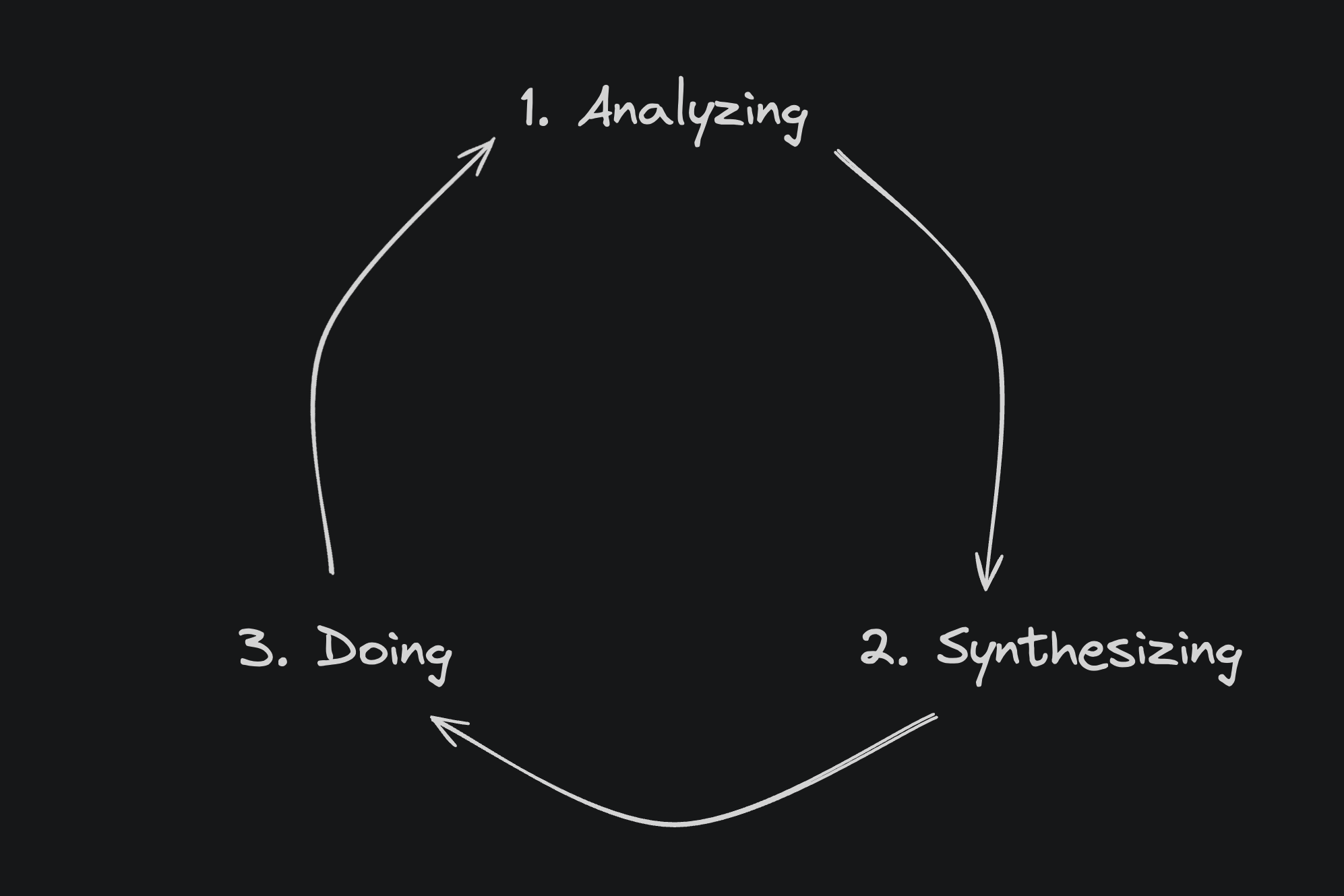

In trading, achieving success transcends mere intuition, requiring a disciplined approach that marries analytical rigor with strategic action. At its heart, this approach is structured around the pivotal concepts of analysis, synthesis, and action—three steps that form the cornerstone of an effective trading process. This methodology not only ensures traders stay abreast of the constantly evolving market landscape but also fosters an environment of continuous learning and skill enhancement.

Analysis, Synthesis, and Action: The Core of Trading

In trading, achieving success transcends mere intuition, requiring a disciplined approach that marries analytical rigor with strategic action.

Analysis is the initial, critical phase where traders delve into the vast ocean of market data, zooming in to uncover insights. It's akin to assembling the pieces of a puzzle, where each piece represents market trends, economic indicators, and financial news. This phase is about gathering information and forming a base for informed decision-making.

Following analysis, Synthesis takes center stage. This phase involves integrating the disparate pieces of data into a coherent whole, discerning patterns and opportunities that were not initially apparent. It's about zooming out, connecting the dots, forming a narrative that explains where the market is heading and why.

The final step, Action, is where insights gained from analysis and synthesis are transformed into tangible decisions. This encompasses the execution of trades based on the synthesized information, applying strategies that aim to capitalize on identified opportunities while managing risks.

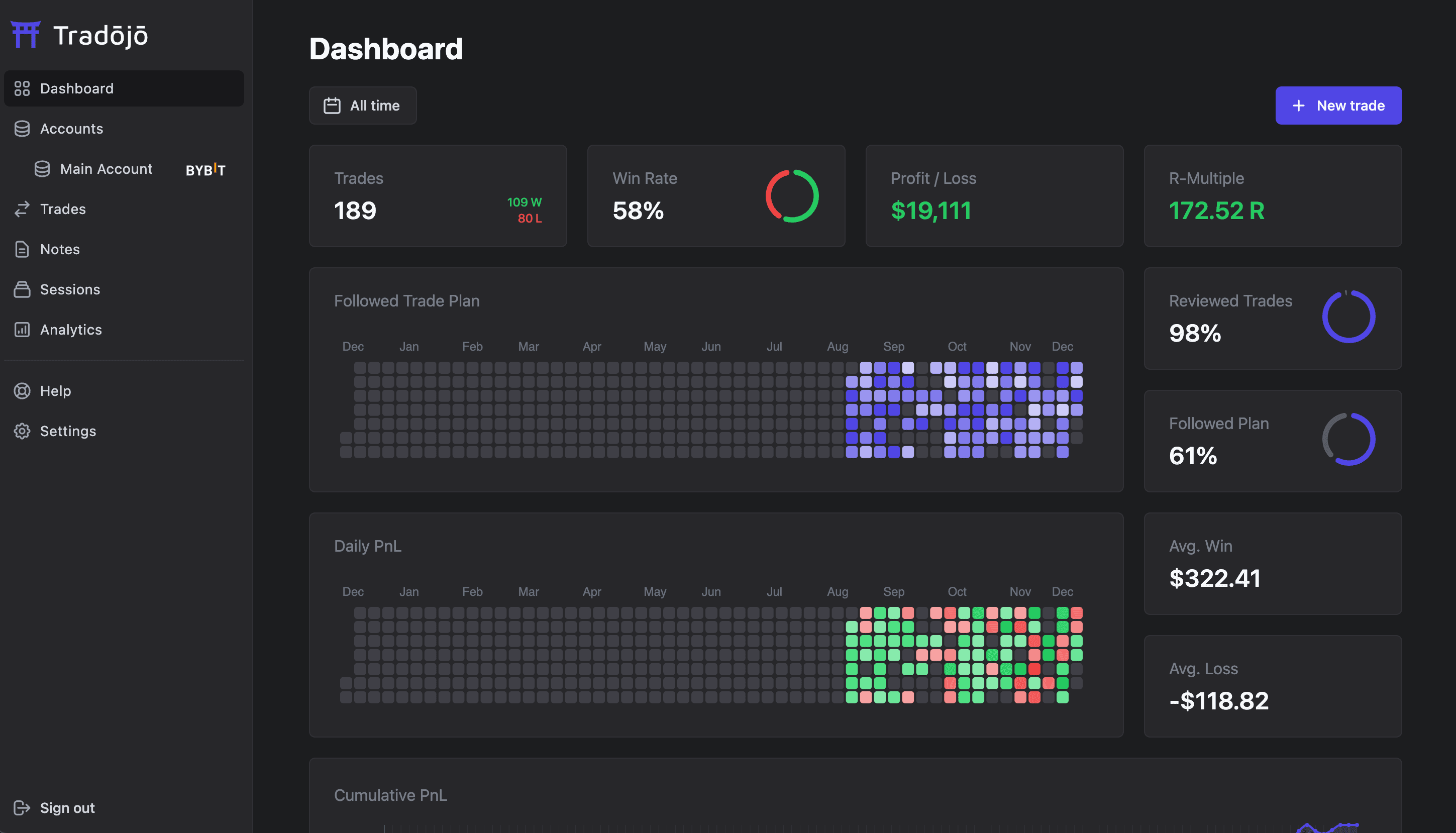

As trading cycles conclude, be it daily, weekly, monthly, or yearly, we turn our evaluative lens inward to reflect on our performance. This involves a thorough analysis of how effectively we've executed our strategies and identified market opportunities.

From this reflection, we set forth goals that aim to build on our successes and address areas for improvement, thereby laying a roadmap for future endeavors. Re-engaging with the market, we put these goals to work, allowing them to guide our analysis, synthesis, and actions moving forward.

This ongoing cycle of reflection and action, both in market engagement and in self-improvement, encapsulates the essence of a trader's journey. It's a continuous loop of observing, acting, and refining – a testament to the dynamic nature of trading and the perpetual quest for excellence.

The Four Elements of a Trading Process

Embedded within this cycle of analysis, synthesis, and action are four foundational elements that further define the trading process: Preparation, Execution, Assessment, and Refinement.

1. Preparation

Preparation extends beyond mere analysis; it involves setting the stage for successful execution through comprehensive market research, strategy development, and trade planning. This stage lays the groundwork for action, equipping traders with the necessary insights and plans to navigate the markets effectively.

2. Execution

Execution is the act of bringing strategies to life in the market. It's the practical application of decisions made during the analysis and synthesis phases, encompassing trade entry, position sizing, risk management, and, ultimately, trade exit. Execution is the action phase materialized, where theoretical strategies confront the realities of the market.

3. Assessment

After action comes reflection. Assessment is a critical review of both the trading process and its outcomes. It involves analyzing the effectiveness of executed strategies, understanding both successes and failures. This stage is crucial for learning from experience, offering insights that feed back into the cycle of analysis and synthesis.

4. Refinement

The final element, Refinement, is about using the insights gained from assessment to improve future trading performance. It involves journaling, tweaking strategies, adjusting risk management protocols, and refining execution tactics. Refinement ensures that the trading process is dynamic, capable of evolving in response to both market changes and personal growth.

Embracing Mastery in Trading

Viewing success through the lens of mastery allows traders to navigate the volatility of short-term outcomes with greater ease. It offers a significant competitive advantage by focusing on the journey of exploration and improvement. Traders who find joy in this journey and adhere to the structured practice of preparation, execution, assessment, and refinement are better positioned to achieve substantial gains, even in times of financial losses.

The essence of trading, therefore, transcends the mere act of buying and selling. It embodies a rigorous, reflective practice that fosters continuous improvement and adaptation. By embracing a holistic approach that includes analyzing market data, synthesizing insights, executing informed strategies, and refining practices based on performance assessments, traders can navigate the complexities of the markets and carve a path towards trading mastery.

The essence of trading, therefore, transcends the mere act of buying and selling. It embodies a rigorous, reflective practice that fosters continuous improvement and adaptation.

Conclusion

The journey to trading mastery is both complex and rewarding, demanding more than just the mechanical execution of trades. It requires a disciplined adherence to a structured trading process that encompasses preparation, execution, assessment, and refinement. This holistic approach ensures that traders not only stay ahead in the rapidly evolving market landscape but also continuously improve their skills, strategies, and psychological resilience.

By embracing the cyclical nature of trading—analyzing data, synthesizing insights, executing strategies, and reflecting on outcomes—traders can cultivate a mindset geared towards continuous learning and adaptation. The essence of trading, therefore, lies not in the act of buying and selling alone but in the rigorous, reflective practice that underpins these actions.

By embracing the cyclical nature of trading—analyzing data, synthesizing insights, executing strategies, and reflecting on outcomes—traders can cultivate a mindset geared towards continuous learning and adaptation.

As traders navigate their path towards mastery, it's the commitment to this comprehensive process that will ultimately define their success in the markets. By integrating these fundamental pillars into their trading routine, traders can unlock their full potential, turning market challenges into opportunities for growth and achievement.

Remember, trading is a skill that takes time and practice to develop. By following these tips and utilizing Tradojo as a trading journal and analytics tool, you can set yourself on the path to becoming a successful trader.