Yearly Review and Planning Guide for Traders

Preface

Introduction to the Guide

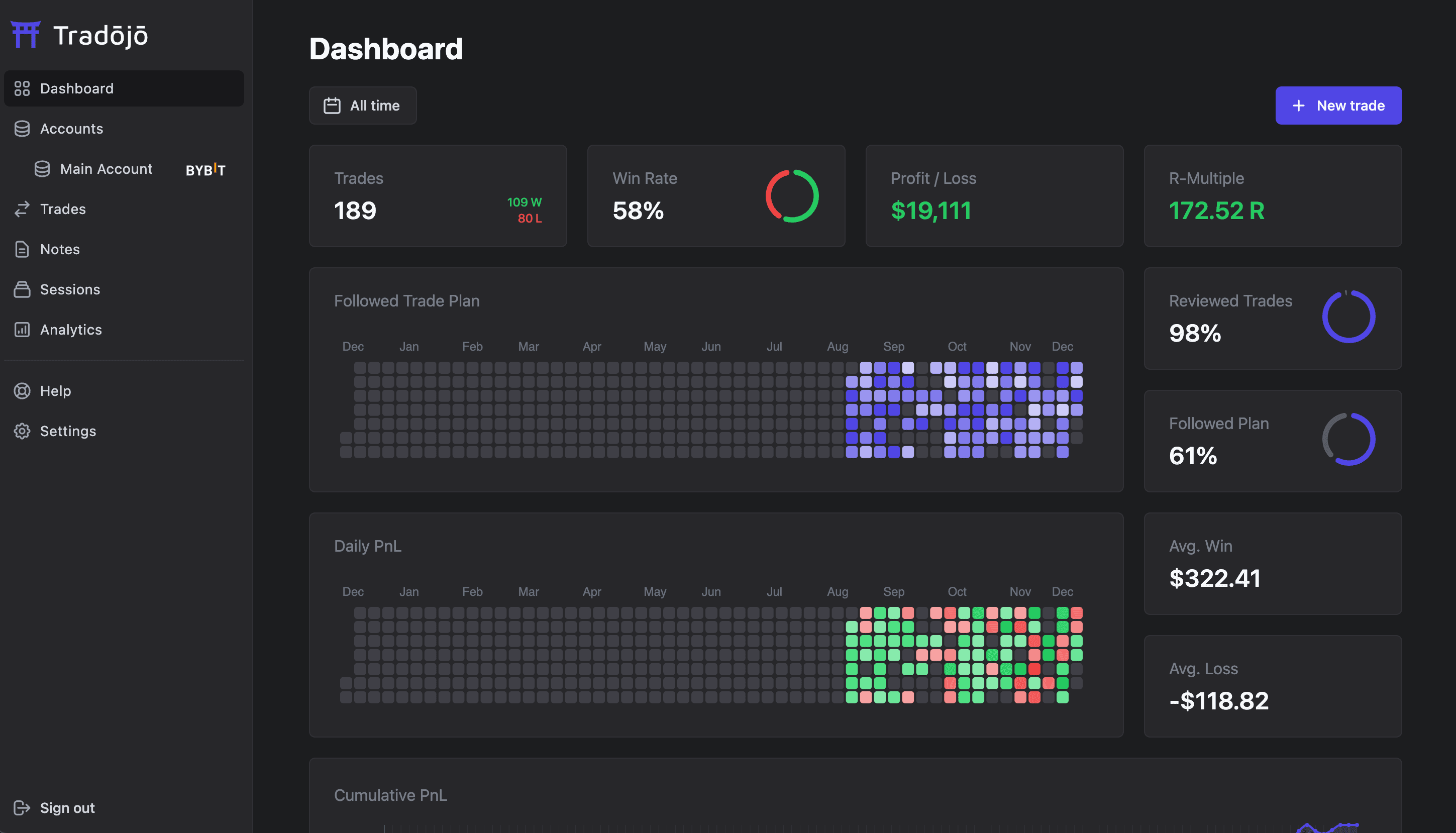

Welcome to our Yearly Review and Planning Guide, an essential resource for traders looking to reflect on the past year and strategically plan for the upcoming one. This guide, leveraging insights and tools like Tradojo, is designed to enhance your trading journey, helping you become a more informed and successful trader.

Importance of Year-End Reviews and Planning in Trading

The trading world is dynamic and demanding. Conducting year-end reviews and planning is not just about assessing profits and losses; it's about understanding the underlying strategies, market dynamics, and personal growth as a trader. This process is crucial for adapting to the ever-changing market and setting yourself up for continued success.

How to Use This Guide

This guide is divided into three parts: Year-End Review, Planning for the Upcoming Year, and Execution and Monitoring. Each section is designed to provide actionable insights and strategies to refine your trading approach.

Part I: Year-End Review

1. Reflecting on the Past Year

Reflecting on the past year involves more than just looking at your profit and loss; it requires a deep dive into your trading goals, strategies, and the psychological aspects of your trading decisions.

Reviewing Your Trading Goals and Objectives

Start by revisiting the goals you set for yourself at the beginning of the year. Were they realistic? Did you achieve them?

- If you did, how challenging where they to achieve?

- If you failed to achieve your goals, explain why.

- If you didn't define goals, explain why.

Understanding the gap between your goals and your achievements can provide invaluable insights.

Analyzing Trading Performance

Evaluate your performance using key metrics such as profitability, R-multiple, win/loss ratio, and drawdowns:

- What was your total and average win/loss (both in absolute terms as well as R)?

- What was your win rate?

- What was your biggest win streak?

- What was your biggest drawdown?

Take a look at the trades of your biggest win streak/drawdown and see if you can find any patterns that lead to it. How was the market condition during this time? Did you break your rules and if so, which ones? Which mistakes do you repeat often?

Consider:

- Did you enter trades too soon/too late?

- Did you take profit too soon/too late?

- Did you place your stop loss too loose/tight?

- Did you deviate from your plan?

- Did you miss trades?

Evaluating Trading Strategies

Assess the decisions that led to successful trades and those that didn't pan out. This evaluation helps in refining your strategies and decision-making process. Drill down into each strategy and evaluate what worked and what didn't.

- Which setups worked and which did not?

- What mistakes cost you money? How often do you repeat each mistake?

- What other factors affected your PnL? (custom tags)

This analysis helps in understanding the effectiveness of your trading strategies.

Assessing Emotional and Psychological Aspects

Trading isn't just about numbers; it's also about how you handle stress, decision-making under pressure, and losses. Reflect on these aspects to improve your mental resilience and trading discipline.

Journaling makes you aware of the emotional and psychological aspects of trading in real-time, and can help you break out of patterns. It gives you space between the emotion and your decision/trigger.

2. Financial Review

A thorough financial review is crucial in understanding the overall health of your trading business.

Analyzing Profit and Loss Statements

Detailed analysis of your P&L statements can reveal patterns in your trading - what worked, what didn’t, and why. Similar to the evaluation of your trading strategies, dig into your data and see exactly how each setup, mistake, and any other factor your track affected your bottom line. Look at your data from different perspectives:

- Setups

- Mistakes

- Custom tags you track

- Time (hold time, weekday, time of day, sessions etc.)

- Fees (commission, funding fees etc.)

- Symbols/assets

- Size

Reviewing Risk Management Effectiveness

How well did your risk management strategies work? Did you stick to your risk parameters? Understanding this is key to maintaining a sustainable trading career.

- How much did you risk per trade in absolute terms?

- What percentage of your account balance did your risk per trade?

- What was your avg. planned RR (risk/reward ratio)?

- What was your profit factor (avg. win divided by avg. loss)?

- Did you take low risk/reward trades?

- Did you risk too much?

Were you consistent with your risk management or are there any outliers? What where the reasons for these outliers? Having strict risk management rules prevents blowing up your account and is the basis of successful trading.

Understanding Tax Implications

Taxes can significantly affect your net trading income. Reviewing your tax obligations and planning for them is essential for financial efficiency.

3. Learning and Development

Continual learning is a cornerstone of successful trading.

Key Learnings and Insights

Every trade and market movement offers a learning opportunity. Reflect on these to enhance your understanding of your trading system. Summarize what insights you have discovered and outline your key learnings of this year. Come back to these key learnings and insights regularly during the upcoming year.

Identifying Areas for Improvement

Be honest about where you need to improve - be it in technical analysis, emotional control, or risk management. What are processes and habits that you want to work on?

- Reflect on your daily routine: Does it help you stay alert and focused during crucial trading times, and also allow you to relax when the odds are not in your favor? How can you enhance this routine?

- Consider unimplemented habits that could boost your trading success, such as maintaining a trading journal or conducting regular performance evaluations. What's holding you back from adopting these habits, and how can you integrate them into your routine moving forward?

- Identify any negative habits that are impacting your trading performance. What steps will you take to eliminate these counterproductive habits?

- Analyze the distractions that caused you to miss significant trading opportunities. Were they related to work, family obligations, or health issues? How can you plan better in the upcoming year to reduce these interruptions, such as more strategic scheduling to balance work and family or prioritizing your health?

What changes can you implement in your trading system to improve your P&L? Come up with new rules and/or adapt existing rules that help you prevent or decrease the impact of your destructive habits and mistakes.

Part II: Planning for the Upcoming Year

1. Setting Goals and Objectives

Setting clear, achievable goals is critical for the coming year.

Defining Realistic Trading Goals

Based on your past performance, set realistic and measurable goals for the next year. It’s essential first to identify the types of trading goals suitable for your trading style, time horizon, and financial objectives. Trading goals can be categorized by their time horizon:

- Long-term Trading Goals: Set over a longer duration like a year, these goals focus on broader financial aims, like accruing a particular amount of trading capital over time.

- Short-term Trading Goals: These are aimed at meeting specific trading objectives within a short timeframe, such as weeks or months. For instance, setting a goal to secure a certain number of profitable trades within a week or achieving a set return on investment (ROI) percentage for the month.

Beyond these primary categories, traders might set other goals, including:

- Performance-based Goals: These focus on enhancing trading efficiency and developing specific trading competencies, like improving risk management strategies or refining trade execution to lessen slippage and trading errors.

- Educational and Self-Development Goals: Fundamental for every trader, these might involve journaling on a daily basis or engaging with various trading resources to broaden your knowledge and insights.

As a trader, you’ll likely blend these goals, ensuring they resonate with your trading style, risk tolerance, and overall financial circumstances.

Aligning Trading Objectives with Your Trading Style

Your trading goals should align with your trading style. This alignment ensures that your trading activities support your broader health and commitments. Your trading style is the approach you adopt for trading decisions, encompassing various factors influencing your trades.

- Consider your time horizon or the duration for holding trades. Day trading might suit you if you prefer trading in volatile assets with significant intraday price movements. Alternatively, swing trading could be more appropriate for longer holding periods.

- Trading styles are diverse, and it’s typical to integrate multiple styles throughout your career. Objectively assess your strengths and weaknesses, being honest about your capabilities.

- Risk tolerance is a major determinant of your trading style. If risk-averse, you might steer clear of high-risk markets like derivatives and cryptocurrencies. It also influences decisions regarding position sizes and entry/exit points.

- Your market expertise and knowledge also play a role. While some traders specialize in a single market, others diversify across various markets. This expertise influences the analysis tools you use for identifying trading opportunities.

Establishing Targets

Set specific targets for different time frames - short, mid, and long-term. These targets should be specific, measurable, achievable, relevant, and time-bound (SMART):

- Specific: Goals should be clear and well-defined.

- Measurable: Goals should be quantifiable for easy assessment.

- Achievable: Goals should be realistic and attainable.

- Relevant: Goals should be relevant to your big picture.

- Time-bound: Goals should have a defined timeline for achievement.

2. Risk Management and Capital Allocation

Effective risk management and wise capital allocation are the backbones of successful trading.

Developing a Robust Risk Management Framework

Create or refine a risk management plan that protects your capital while allowing for growth.

- Establish Loss Limits: Determine the maximum amount you're willing to lose per day, per trade, and per month. These limits should be in line with your overall capital and risk tolerance.

- Use Stop-Loss Orders: For each trade, set a stop-loss order to automatically exit a position when a certain price is reached, minimizing potential losses.

- Position Sizing: Decide the size of your positions based on the amount of risk you are willing to take. This involves calculating the potential loss on a trade and adjusting the position size accordingly.

- Adopt a Risk-Reward Ratio: Before entering any trade, determine the expected reward in relation to the risk. A common risk-reward ratio is 1:3, where for every dollar risked, three dollars are expected in return.

- Think in R-Multiples: Thinking in relative terms compared to absolute numbers can take pressure off your shoulders. Trading is a game of probabilites, and R-multiple is a great concept that helps assess the performance of trades relative to the risk taken.

- Diversify Across Instruments: Spread your risk by not allocating too much capital to a single asset or market. Diversification can help mitigate systemic risks.

- Regularly Review Your Risk Management Plan: Markets evolve, and so should your risk management strategies. Regularly review and adjust your plan to stay aligned with current market conditions.

Capital Allocation Strategies

How you allocate your capital across different trades or strategies can significantly impact your overall risk and return.

- Assess Your Trading Style: Your capital allocation should match your trading style. Day traders may allocate capital differently than swing traders or long-term investors.

- Set Allocation Limits: Define how much of your total capital can be allocated to any single trade or strategy. This prevents overexposure to any one position.

- Utilize Correlation Analysis: Understand how different assets move in relation to one another. Allocate capital to trades that offer diversification benefits.

- Allocate Based on Performance: Allocate more capital to strategies and trades that have a proven track record of performance, while remaining within your risk parameters.

- Consider Market Conditions: In volatile markets, consider reducing position sizes to manage risk, or allocate capital to less volatile instruments.

- Evaluate Opportunity Cost: When allocating capital, consider the potential returns you might be giving up. Opportunity cost is a key consideration in capital allocation.

- Implement a Tiered Approach: Allocate capital in tiers or tranches rather than all at once. This allows you to enter a position at different price levels and manage risk more effectively.

- Allocate for Hedging Purposes: Use a portion of your capital for hedging to protect against market downturns. Hedging strategies can include options, futures, or inversely correlated assets.

- Review Your Allocations Regularly: As your portfolio grows and market conditions change, your initial allocations may no longer be optimal. Review and adjust them periodically.

- Keep a Reserve: Always have a reserve of capital that is not exposed to the market. This reserve can protect against margin calls and also provide liquidity for new opportunities.

Part III: Execution and Monitoring

Execution and monitoring are pivotal stages where your trading strategies and planning are put to the test. This phase is about discipline, consistency, and the ability to adapt to new information. Tradojo can be instrumental in this phase, providing tools to track and analyze your trading.

Implementing Your Trading Plan

Once your plan is in place, it’s time to execute it with discipline and consistency.

- Pre-Trade Preparation: Before the market opens, ensure you're ready with a checklist that includes market analysis, news events to watch out for, and a review of open positions.

- Set Entry and Exit Points: Before you enter a trade, define your entry points, target profits, and stop-loss levels. This helps remove emotion from decision-making once you're in the trade.

- Execute Trades Consistently: Follow your trading plan to execute trades. Consistency in execution allows for reliable data collection which is essential for performance review.

- Use Tradojo for Trade Tracking: Leverage tools to log each trade, including the setup used, entry and exit points, trade duration, and notes on the trade’s performance. Tradojo automatically imports and calculates this data from exchanges via a secure API key.

- Journaling: Maintain a trading journal to document your thought process, emotions, and observations. Journals are invaluable for learning from both successes and failures.

- Risk Management in Action: Adhere strictly to the risk management rules set out in your plan.

- Performance Analysis: Use analytics tools to evaluate the performance of your trades. Look for patterns in winning and losing trades to identify what is working and what is not.

Monitoring and Adjusting Your Plan

Regularly review your trading performance and be willing to adjust your strategies in response to changing market conditions or personal circumstances.

- Scheduled Performance Reviews: Set a regular schedule, whether daily, weekly, or monthly, to review your trading performance against your set goals and objectives.

- Adjusting Strategies: Be prepared to adjust your trading strategies based on the performance review outcomes. If certain aspects of your strategy are not working as expected, refine them.

- Market Condition Adaptation: Stay abreast of market conditions. If the market changes character, be ready to adapt your trading plan accordingly. This may involve shifting from aggressive to conservative strategies, depending on market volatility and economic events.

- Risk Profile Adjustment: If your personal circumstances change, for example, if there's a change in your financial situation or risk tolerance, adjust your risk management strategy to reflect this.

- Continual Learning: Commit to continuous education. The markets are always evolving, and so should your knowledge and skills.

- Feedback Loop: Create a feedback loop from your trade analysis to your strategy development. Use insights gained from trade reviews to refine your approach.

- Embrace Technology: Use the latest technological tools for monitoring the markets and your trades. Tradojo can provide advanced analytics and insights to assist in this process.

- Psychological Assessment: Regularly assess your psychological state and its impact on your trading decisions. Be mindful of overconfidence, fear, or other emotions that can lead to poor decision-making.

- Peer Review: If possible, engage with a trading community or mentor to get an outside perspective on your trading plan and performance.

- Backtesting Adjusted Strategies: Before implementing any major changes to your trading plan, backtest the new strategies to ensure they are viable.

By meticulously executing and continuously monitoring your trading plan, you create a dynamic system that can adapt to changes both within and outside the markets. The key is to remain disciplined, yet flexible enough to adjust when necessary to protect your capital and take advantage of new opportunities as they arise.

Conclusion

As we wrap up this guide, remember that the journey of a trader is one of continual learning and adaptation. By following the steps outlined in this guide, and utilizing resources like Tradojo, you set the stage for a successful and profitable year ahead in trading. How will you use the insights from this past year to shape your trading strategies for the upcoming year?